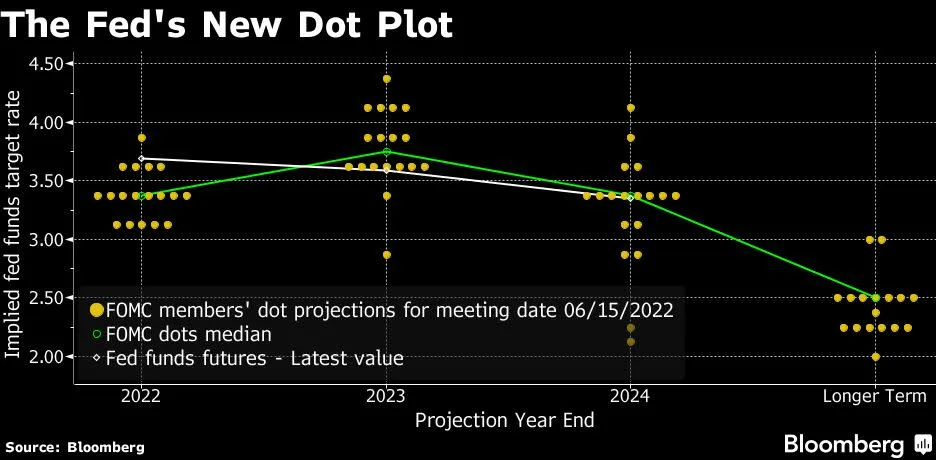

美國通脹形勢急速惡化,聯儲局最新宣布加息0.75厘,創出1994年以來最大加幅,聯邦基金利率目標區間升至介乎1.5至1.75厘,而點陣圖顯示,官員預計利率至今年年底將升至3.4%。聯儲局主席鮑威爾會後在記者會稱,大幅加息不會成為常態,而美股在聯儲局公布議息結果後抽升。

聯儲局議息會議後發表聲明指,居高不下的通脹反映疫情、能源價格上漲及供需失衡,局方高度關注通脹風險,並「致力通脹率回復到2%的水平」。鮑威爾在記者會上指,壓抑通脹率的情況下同時維持低失業率並非易事,在出現令人信服證據顯示通脹有所回落以有,局方不會輕言勝利。

最新點陣點預計年內利率會升至3.4厘,較3月份預測的1.9厘,高出1.5厘,同時意味住今年內聯儲局仍需加息175點子。

至於縮減資產負債表計劃方面,聯儲局將繼續每月縮表475億美元,當中美國國債及按揭抵押證券分別佔300億及175億美元,往後會將上限提升至950億美元,分別為600億美元國債及350億美元MBS。

聯儲局議息會議聲明

Overall economic activity appears to have picked up after edging down in the first quarter. Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher energy prices, and broader price pressures.

The invasion of Ukraine by Russia is causing tremendous human and economic hardship. The invasion and related events are creating additional upward pressure on inflation and are weighing on global economic activity. In addition, COVID-related lockdowns in China are likely to exacerbate supply chain disruptions. The Committee is highly attentive to inflation risks.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 1‑1/2 to 1-3/4 percent and anticipates that ongoing increases in the target range will be appropriate. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in the Plans for Reducing the Size of the Federal Reserve’s Balance Sheet that were issued in May. The Committee is strongly committed to returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

更多最新最熱最有用財經金融地產資訊 請即登記成為Finance730會員

追蹤Finance730 動向 官方網頁

▼緊貼最新市場走勢 Facebook

▼消閒生活 時尚品味 Instagram

▼投資教室 專題研究 YouTube